The first third robo-advisor in Malaysia was officially launched last week. Wahed Invest, is the first Halal robo-advisor that provide investors a chance to invest with shariah-compliant companies and bonds.

In comparison to MyTheo and Stashaway, I felt that to invest in Wahed Investors my preference as I have always wanted to invest in those largest companies in the USA, such as Apple, Facebook, Microsoft, Google, etc. But to invest directly will be very cost-ineffective. To invest via the only US Dollar-denomination ETF, MyETF Dow Jones US Titans 50, that invest in these same companies, you have to open a US dollar account with one of the local banks and the process is tedious.

But now, with Wahed, it becomes so much easier. Just invest in Wahed Invest and depending on the portfolio that you choose, you will invest up to 45% of your fund into the ETF that I mentioned just now. The rest will be invested in local Sukuk, Malaysian stocks and in gold.

I have invested RM 100 and chose the aggressive portfolio to invest in and my allocation is as follows:

45% — MyETF Dow Jones US Titans 50

25% - RHB Islamic Bond Fund

17.5% - MyETF MSCI Islamic Dividend ETF

10% - Tradeplus Shariah Gold Tracker

2.5% - Cash

I find this allocation very well thought of. And it does make investing more hassle-free.

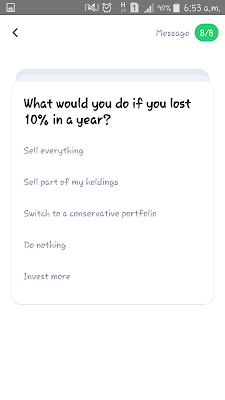

To start investing in Wahed Invest, all you have to do is to download the app, do the standard registration process, answer a few simple questions to give an idea to Wahed Invest on what type of investor are you. You will be proposed a portfolio and if you agree, the next step will be to fund your account. The minimum investment is RM 100 and there is no maximum amount. Once they receive the fund and allocate the funds according to your portfolio, you will be able to see the progress in the app.

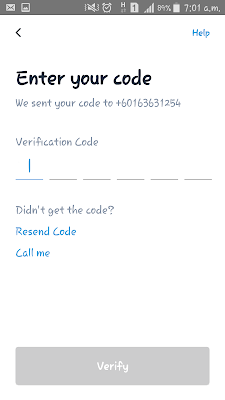

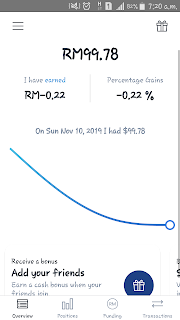

As RM strengthen against the US Dollar, my portfolio is losing a bit of the amount that I have invested but I have a lot of confidence that things will get better as time goes by.

By the way, I'll like to inform about the management fee charged by Wahed, for investment up to RM 500,000, the fee that they are charging is 0.79% and 0.39% is you invested more than RM 500,000. The investment fee does make a lot of difference and Wahed Invest's fee is definitely slightly lower than Stashaway (0.2 to 0.8%) and MyTheo (0.5 to 1.0%). This is another advantage of investing in Wahed Invest.

So, are you ready to start investing? Wahed Invest actually wants to supercharge your investment. So, if you sign up using my referral code (limwei1), Wahed Invest will reward you with an additional RM 40 for keeping your investment in Wahed Invest for at least 30 days to Wahed Invest account (the RM 40 will be credited into your account after 30 days).

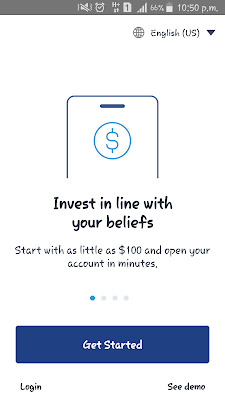

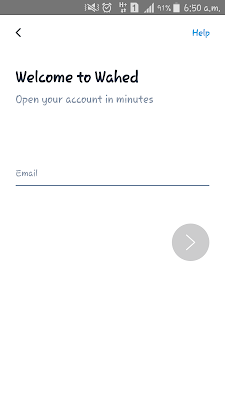

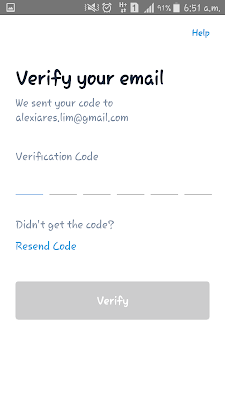

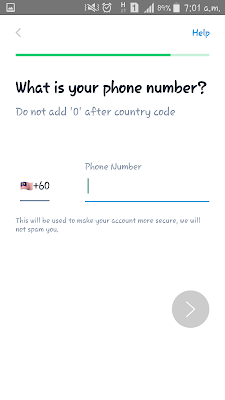

Below are some snapshots of the process of my going my registration and how my investment progress looks like now.

|

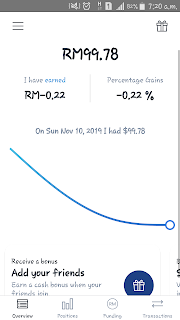

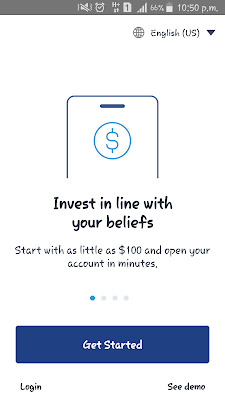

| First Screen |

|

| Getting Started |

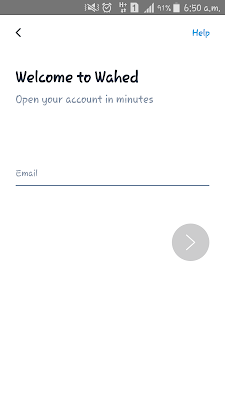

|

| Start with your email address |

|

| Need a password too. |

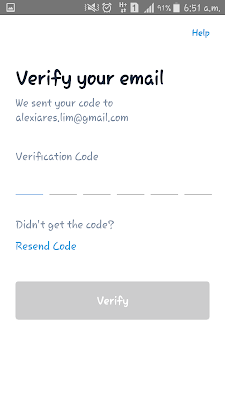

|

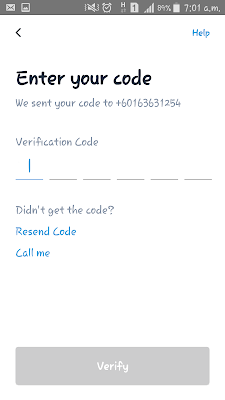

| Verify your email with a 6-digits code |

|

| Enable Notification for helpful reminders |

|

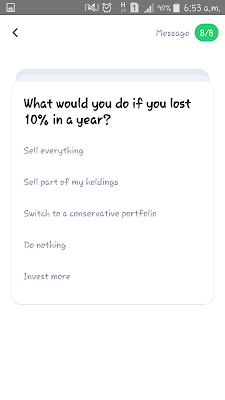

| Questionnaire to check what portfolio suits you best. |

|

| What is your age group? |

|

| What are you investing for? |

|

| What is your monthly income? |

|

| How much do you have in savings |

|

| Your income sources (current and future) are: |

|

| How familiar are you with investing? |

|

| Describe your attitude towards investing? |

|

| What will you do if you lost 10% in a year? |

|

| Portfolio suggestion |

|

| Allocations |

|

| Details on where you are investing in |

|

| Creating your account |

|

| Your name |

|

| Last Name |

|

| Date of Birth |

|

| Residential and mailing address |

|

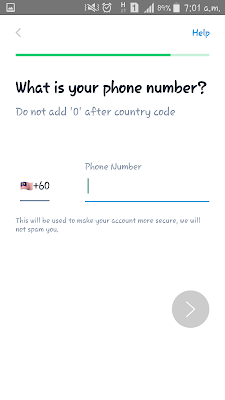

| Phone number |

|

| Verification Code for your mobile phone |

|

| Investment eligibility |

|

| Remember to add my referral code: limwei1 |

|

| Portfolio progress |

Hi! Can i use some of the pictures to promote wahed investment?😅

ReplyDelete